Thursday, December 31, 2009

Africa Can … End Poverty

“For the first time in 30 years, Sub-Saharan Africa is growing at the same rate as the developing world (save India and China). For more, see the book “Africa at a turning point?”. If African countries can sustain this growth and make it more widely shared, the dream of a continent free of poverty can become a reality.”

In a recent post, “African Successes” (2009-09-17), he lists 42 striking success stories from which around 20 cases will be selected for in-depth study in order to evaluate the drivers of success, the sustainability of outcome, and the potential for scaling up successful experiences.

In a lighter perspective, the New York Times signals Africa’s renewed visual and artistic influence that is touching film, music and fashion here .

Is a new Afrocentric wind rising?

Tuesday, December 29, 2009

The Stock Market Crash and the Real Economy

The boom and bust episode, exceptional by historical standards, is quite apparent in the Price/Earnings series, here:

Old Media and New

Read the New York Times story here .

Friday, December 25, 2009

Tax Competition and Public Services : California vs. Texas

Read the William Voegli paper here .

My comment: one suspects that high taxes European countries follow or surpass the same Californian model. States’ real productivity has probably reached a phase of decreasing returns.

Hat tip to Tyler Cowen (Marginal Revolution).

Tuesday, December 22, 2009

Stopped Clocks and Cooling Hysteria

Want to read something really different about current scares? Have a look at Macromania, the blog of David Andolfatto, and especially the two recent posts on Doctor Gloom (December 18) and climate change (December 15) here .

Enjoy.

Monday, December 21, 2009

William Easterly on Summitry

« We have had tons of international summits, almost all of them have failed to produce anything of value. Why do we keep setting our expectations so high? Maybe we should try some other path of change besides the Big International Summit?”

My comment: For global problems too, decentralized coordination is more realistic – today , in the extended second twentieth century – than attempts at world level centralization.

Sunday, December 20, 2009

Greece, and the ECB as a Regional IMF

Now Simon Johnson writes in The New Republic here that the Eurozone and ECB are a regional IMF, sort of. I agree.

Thursday, December 17, 2009

State Spending vs. Tax Cuts

This was after all a policy that an American “liberal” such as John Kennedy adopted, following the advice of Paul Samuelson.

It is a policy that should claim the higher priority to boost the over-taxed European economies.

The Grabbing Hand

Read the complete post here .

Hat tip to Mark Thoma.

Tuesday, December 15, 2009

Political Short-Termism

Whereas “there have been few times so good for public budget management as the “great moderation” years of solid growth and low inflation that preceded the present crisis, (…) the vast majority of EU countries ran substantial budget deficits (…)

It is ironic that in the current EU, the new regulatory measures are being written and promoted primarily by the large Western countries whose financial systems proved to be the most vulnerable in the crisis. Just imagine how it would look if new financial regulations in Central and Eastern Europe were written mostly by Latvians.”

Monday, December 14, 2009

Big Banks Get Bigger

Read his comment here .

Samuelson and Random Asset Prices

But the question that comes next is: can we identify prices that are not properly anticipated and estimate the biases in anticipations?

Read the paper here . Hat tip to Tyler Cowen (Marginal Revolution).

Sunday, December 13, 2009

Paul Samuelson Dies at 94

A really superior mind who durably transformed the field of economics.

Saturday, December 12, 2009

Tracking the Recession and Coming Recovery

Casey Mulligan has developed an intriguing real business cycle model which has « no adverse productivity shocks, no shocks to capital markets (these variables just react to events in the labor market), no monetary policy, and no fiscal stimulus. Simply put: I view this as a one (type of) shock recession, and the labor market is ground zero for that shock.

This version of the model has a labor market distortion that gets progressively worse for the two years (2008 & 2009), at which point it partly reverses itself although never getting back to pre-recession levels.”

OK all this seems extremely difficult to believe as a description of the current recession, but surprisingly the model’s simulations do track observed evolutions in labor usage, consumption, labor productivity and investment rather well (see Mulligan’s blog “Supply and demand”, "What Happens Next? Part II", December 9).

Seven Lean Years for the US ?

Note that the current unemployment rate is quite similar to the one reached during the 1981-82 recession (10.8 percent).

Read his paper here .

Wednesday, December 9, 2009

Two Real Estate Booms and Busts Compared

Paul Volcker Joins the Classical Banking Club

Read the Wall Street Journal article here .

The US and the Payroll Tax

As a conclusion he wonders “Will it be Democrats who first harness the revenue-collection power of the payroll tax? Or will Republicans appreciate its favorable incentives?”

I disagree with the last sentence claim: the incentives provided by the payroll tax are not “favorable” but strongly detrimental to labor supply. And the transatlantic differences in its level go a long way to explaining differences in hours worked per capita, and consequently production per capita, on both sides of the Atlantic as Edward Prescott showed (see my paper "Comment gagner plus" on my homepage here ).

Read the Mulligan post here .

Saturday, December 5, 2009

The Great Trade Collapse and Crisis Theory

According to Richard Baldwin in the introductory chapter of the new book he is editing for the world’s trade ministers WTO gathering in Geneva, Causes, Consequences and Prospects,

“World trade experienced a sudden, severe and synchronized collapse in the late 2008 – the sharpest in recorded history and deepest since WWII.”

Friday, December 4, 2009

The Global Savings Glut Theory of the Great Recession

I agree that once a huge amount of liquidity has been deluged on the world economy it can only be returned to a more reasonable level by several successive asset markets crashes that dissipate some wealth each time, absent a new innovation boom that would require a large amount of new real investment.

Read her paper here .

Macroeconomic Theory Did Not Fail, Sumner

According to him the Federal Reserve did cause the contraction by its ultra-restrictive monetary policy in 2008. He however does not exclude that some real supply side difficulties also contributed to the crisis, but that too can be inserted into the AD-AS diagram.

Read the paper here .

Thursday, November 26, 2009

Feldstein on Euro Zone Survival

Those countries such as Spain, Greece, Ireland or Italy, whose economies remain relatively weak oppose tighter monetary policy and they might benefit from pursuing an independent monetary policy to adjust their currencies to more competitive levels.

Read the complete paper here.

Hat tip to Mark Toma.

Tuesday, November 24, 2009

Asia Rising, Europe Declining, US Stable

Greg Mankiw posts a striking graph on his blog, describing the evolution of shares of the world GDP by regions (above) since 1969. While the decline of the US economic dominance is frequently presented as the trend of the future, Europe really is the continent which is losing its relative economic weight to Asia.

Saturday, November 21, 2009

Taxes Compared

The Economist publishes a useful comparison of the state’s take in the economy (see table above). This is not, however, a comprehensive measure of the size of states in the economy since states also own firms, issue debt to finance part of their spending, and use regulations to orient private activities.

Friday, November 20, 2009

Minimalist Europe?

Excerpts:

“You could say it’s a sign that people are tired of assigning more power to Brussels said one diplomat.”

“When the Lisbon treaty (originally the EU constitution) was first mooted in 2001 by the Belgian EU presidency, it was seen as one last push by European federalists to transfer power to Brussels, including national policies on tax and foreign affairs.

That push was rebuffed, and last night’s dinner in Brussels was the coda to that process. (…) Europe’s leaders asserted the supremacy of the nation state: the new president and foreign policy chief would be servants, not the masters, of the national capitals.”

While such forecasts of what a nominated politician will do in office are notoriously hazardous, the symbolic aspect of the choice made yesterday should not go unnoticed: the new president has been (briefly) a prime minister of the European country which met the least success at building a nation state over differences in languages and traditions, and that has been considered recently as being on the verge of implosion. A bad omen indeed for those bent on centralizing even more the European Union.

Tuesday, November 17, 2009

Don’t Cut Deficits, Cut Taxes

Now what we need at present, both in Europe and in the U.S., is a continued fiscal stimulus to sustain the recovery, to be followed later by a reduction of the Debt/GDP ratio inflated by the public spending policies adopted during the crisis. If Alesina and Ardagna are right, and they may well be, a tax reduction now, followed by a public spending reduction (without tax increase) later, when private spending will have picked up, would be the best macroeconomic policy to adhere to.

The “deficit hysteria” (the excessive fear of deficits) currently fashionable would lead, on the contrary, to increase taxes that would damage recovery prospects, while the pursuing of public spending policies, which were useful during the crisis when private spending was contracting, would not add significantly to growth when expansion returns, and would on the other hand incite governments to increase taxes permanently, thus jeopardizing future growth.

Cutting taxes now would also give governments time enough to devise a well prepared future public spending cut program.

Tuesday, November 10, 2009

Dollar, Euro, Exports

Indeed:

“The value of the dollar is the main determinant of the price of U.S. exports in other countries. If the dollar falls in value, the price of U.S. exports declines measured in the currency of other countries.”

Since Baker suggests that the WSJ be nominated for a “Pulitzer for journalistic incompetence” due to that omission, I suggest that most European economists and all of the European political class share this Pulitzer award for never mentioning that the value of the Euro vis-à-vis the dollar, and the implicit value of the “notional” French Franc, Lira, and Peseta vis-à-vis the notional Deutsche Mark are responsible for substantial export difficulties and for the resulting contraction in activity.

Congratulations to the laureates.

Monday, November 9, 2009

Warren Buffett, the Railroads, and the Renminbi

The Buffett move could also be interpreted as a bet on the rise of oil prices, because in that case transport by trains becomes much cheaper than transport by trucks, notes a reader of The Baseline Scenario.

Moreover both effects could happen simultaneously ...

Monday, November 2, 2009

Saturday, October 31, 2009

Economics Bashing Wrong, Lucas

Friday, October 30, 2009

The Dollar Carry Trade and the Next Bubble

Thursday, October 29, 2009

Goodhart vs. Kay

He is wrong however on one point at least: being in favor of smaller, more specialized banks, as an objective for the future, after a reform of the system, is not the same thing as claiming that financial authorities should not have helped large diversified banks avoid bankruptcy in the recent past. The impact on the economy would have been devastating given their sheer size, and it is precisely for that reason that banks should be compelled to downsize and re-specialize in the future. The failure of one or a few smaller investment banks would then not jeopardize the whole economy, which is the main point of the "too big to fail" reform proposal.

He then argues that in a narrow banking system, depositors would shift their funds towards risky financial institutions during relatively safe periods, only to return to safer institutions when risks increase, and thus would exacerbate the cyclical instability of the economy. But that would not be the case if investment banks were not allowed to manage current payments for depositors, just as corporations in general are not allowed to manage the payments needs of their shareholders.

Soros vs Markets

Wednesday, October 28, 2009

Imperfect Financial Information

Market prices can reflect all the available information, and nevertheless change drastically from one period to another. We should not forget that information about the environment is constantly changing too.

So, after all, the market for information is imperfect indeed since most people who write in the field do not get the basics right.

Hat tip to Greg Mankiw.

Tuesday, October 27, 2009

British Schadenfreude

According to the City’s newspaper: “A strong common currency is better than none at all. Before, dollar strength would set off currency chaos by creating incentives for beggar-thy-neighbour attempts at weakening national currencies. Not only was this self-defeating: it also softened exporter’s market discipline, since relying on policy action became easier than raising productivity.”

Now indeed the pleasures of currency depreciation are reserved for the happy few: the US and the UK. And of course, currency depreciations are all the more effective when the partners in exchange do not retaliate. That’s exactly what has strengthened the German economy competitive position within Europe since the 1990s. Could it be that the Financial Times advice is slightly biased towards British self interest?

Sunday, October 25, 2009

Health Insurance Transatlantic Differences

I do favor such a system for European countries where universal health insurance already exists, but is tax financed. The US case is different since health insurance is optional there. The debate thus is mostly about the desirability (or not) of universal coverage.

Wednesday, October 21, 2009

Volcker, Stiglitz, King, and Classical Banking

At the same time the British get serious about it, and especially Mervyn King, governor of the Bank of England, who called on Tuesday night for banks to be split into separate utility companies and risky ventures, saying it was “a delusion” to think tougher regulation would prevent future financial crises (The Financial Times, October 20).

In this most important debate we side with Volcker, Stiglitz and King, because, among other reasons such as a limited belief in the independence and efficiency of regulations (as the late George Stigler clearly explained), the overall abundance of information in the early 21st century calls for smaller, less diversified corporations, not bigger unfocused and difficult to control ones. “Too big to fail” is the major risk in finance for the near future, and banks are all too willing to go that way again. A modern version of the Glass-Steagall Act is a must in international bank reform.

Tuesday, October 20, 2009

Common Sense from a European Economist (at last)

It comes from Willem Buiter, a professor at the London School of Economics, who writes in the Financial Times here that “the euro has become a currency on steroids. (…) The strength of the currency is hurting the exporting and import-competing sectors of the Euro Area. Unemployment and excess capacity continue to rise.”

And he then adds: “any disinterested observer would be hard-pushed to avoid the conclusion that the Eurozone is paying the price for the ECB’s excessively tight monetary policy.” Moreover “The ECB is violating its price stability mandate by tolerating, aiding and abetting deflation in the Euro Area.”

The conclusion: “If the ECB persists in acting in a willfully asymmetric manner, its cherished independence will be taken from it. The letter of the Treaty will provide no protection against popular anger and political opportunism.”

Fair enough. But two observations are in order: first, this analysis points in the right direction but covers only half of the problem. As explained in my previous post, most of the foreign trade of the Eurozone countries is intra-zone. It follows that adjusting – at last – the euro exchange rate vis-à-vis the other major currencies (dollar, yen or yuan) will not solve the basic intra-zone imbalance of implicit (or shadow) exchange rates, for instance between Germany and Italy. This is a source of permanent real disequilibrium, mostly in Italy since Germans have a very low tolerance for inflation and much higher acceptance of deflation and wage moderation, or even of wage cuts. It is a good recipe for Germany but not so for France, Spain or Italy.

And second, where were you professor Buiter when the battle for and against the creation of the euro was raging, and when the euroskeptics were precisely warning in advance against the dangers that have become so real, alas, today? It would have been much better for Europeans if this dramatic mistake had been avoided from the start.

So let’s repeat the basic warning: a euro depreciation (did someone say “competitive devaluation”?)is necessary. But it will NOT solve the long term problem of inadequate and disequilibrium intra zone implicit exchange rates.

Monday, October 19, 2009

Euro vs Growth (again …)

A cheaper Euro, however, would not really suffice to strengthen growth here since there is also considerable intra-eurozone misalignment of “implicit” – or “shadow” --national exchange rates, while the intra-zone trade represents the largest part of member countries foreign trade.

Eventually, a few governments will have to face the harsh reality: the creation of the Euro was a mistake, their mistake, which only benefitted local bankers and cartelized industries ... and, yes, Germany.

Saturday, October 17, 2009

Alan Greenspan Joins the Classical Banking Club

“If they’re too big to fail, they’re too big, (…). In 1911 we broke up standard Oil – so what happened? The individual parts became more valuable than the whole. Maybe that’s what we need to do.”

Let us add that in 1911 very large firms usually had a big competitive advantage over smaller ones, while the reverse is true today. All other sectors’ largest firms have been downsizing, on average, and the conglomerates of the 60s disappeared a long time ago. Indeed, the banking sector has been able to avoid such an adaptation because of state support.

Read the article here .

Thursday, October 15, 2009

Why Financial Regulatory Reform is Not the Answer

L’euro cher favorise-t-il la croissance ?

Aujourd’hui le constat macroéconomique élémentaire du contraire est parvenu enfin jusqu’aux colonnes du Monde : le dollar faible, c’est-à-dire l’euro fort, coûte cher en croissance perdue aux pays membres de la zone. Autre expression de la même absurdité, un peu moins triomphante, qu’il devient plus difficile d’asséner, l’expérience ayant été abondamment faite et la preuve, hélas, infligée à notre économie: « la valeur du taux de change n’affecte pas la croissance économique », ou encore, « les dévaluations ne renforcent pas la compétitivité des entreprises exportatrices ni de l’économie en général ». Sauf que les Etats-Unis, où les économistes sont plus courageux et les technocrates moins dominants, savent bien, eux, utiliser la faiblesse de leur monnaie quand nécessaire et avec effet.

Faut-il répéter encore que dans une économie ouverte le taux de change est LE prix le plus important ? Faut-il encore répéter qu’en ce qui concerne l’Euro toutes les affirmations officielles et toutes les promesses étaient purement et simplement mensongères ? (voir mon article « Les promesses de l’euro : Tout était faux », Il Sole-24 Ore, décembre 2001 et Renaissance des Hommes et des idées, juin 2002, disponibles et téléchargeables sur mon site http://jjrosa.com).

Faut-il encore répéter que seule la sortie de l’euro (alliée à la réduction de l’impôt sur le travail) donnera une bouffée d’oxygène à la croissance, en France et dans les autres pays de la zone euro qui ne font pas « naturellement » partie (de par leurs caractéristiques structurelles) de la petite zone mark (Allemagne, Autriche, Belgique, Luxembourg, Pays-Bas)?

Oui sans doute. Puis-je alors conseiller la relecture de mon livre de 1998 : L’erreur européenne ? Oui certainement car il montre, avec le recul de l’expérience, à tous ceux qui se veulent « pragmatiques » et récusent par ignorance les vertus d’une analyse économique fondamentale, ce que peuvent coûter, très concrètement, dix années d’expérimentation hasardeuse aux conséquences très prévisibles – et prévues – coût supporté par l’économie en général et – très pragmatiquement - par les Français en particulier.

Alors répétons : il n’y a que deux réformes - et deux réformes seulement (oublions les taxis et autres distractions pascaliennes) - qui soient susceptibles de sortir l’économie de l’enlisement qu’elle subit depuis les années 80: la sortie de l’euro (et donc la possibilité d’adopter une politique monétaire et de change enfin conforme aux nécessités de l’environnement français) d’une part, et l’allègement radical des cotisations sociales (avec maintien intégral des transferts en faveur des plus faibles salaires pour la couverture d’assurance maladie) telle que décrite dans mon récent article « Comment gagner plus » publié dans la revue Commentaire (numéro du Printemps 2009) et disponible sur mon site, de l’autre.

Sortie de l’euro, car un simple assouplissement de la gestion monétaire de la BCE et un endiguement de sa hausse par rapport au dollar, ne changera rien à la fixité des parités de change entre pays européens, gelée « définitivement » par l’euro, alors que ces parités implicites se situent à des niveaux de déséquilibre, et tandis que l’essentiel de nos échanges extérieurs se fait à l’intérieur même de l’Europe. Il faut donc sortir de l’euro, quitte à le laisser subsister aux bons soins de l’Allemagne (voir également mon article "D'abord sortir de l'euro ... condition de la reprise, de l'emploi, et des réformes de structures", décembre 2005).

Après avoir payé très cher l’absurdité ubuesque, mais étroitement intéressée, de nos technocrates pendant vingt ans et plus, peut-être y a-t-il, aujourd’hui au moins, quelque espoir d’une prise de conscience de la réalité des choses ?

Merci à un lecteur fidèle, Thierry, pour m’avoir signalé cet article.

http://www.lemonde.fr/economie/article/2009/10/14/la-zone-euro-paie-tres-cher-l-addition-d-un-dollar-trop-faible_1253818_3234.html

Tuesday, October 13, 2009

The Right to Health and Limited Generosity

Altruistic intentions, given a limited amount of generosity, thus result in more inequality, not less.

In Praise of Practical Economics ( … at last)

Monday, October 12, 2009

The Nobel Goes to the Economics of Organizations

A good description of the laureates’ contributions is presented by Michael Spence here .

Hat tip to Greg Mankiw for the reference.

Thursday, October 8, 2009

Feldstein Joins the Health Voucher Club

Edmund Phelps is also in favor of reducing the payroll tax in order to increase workers compensation, but since he does not explain how to reduce public spending without penalizing lower income families, it is not really a viable option. For a solution to this problem a health voucher is necessary, and coupled with a mandatory purchase, it is economically much more efficient than a publicly supplied, payroll-tax-financed, universal health insurance.

The time for reform apparently is coming.

Posner (and Becker) on Health Insurance Systems

There are many insurance companies, and people can switch freely among them. Copayments or deductibles are larger, and as a result the average out-of-pocket cost of health care is higher in Switzerland then in the United States. But the aggregate cost of health care is much lower in Switzerland – 11 percent of GDP versus our 16 percent – though higher than in any other country besides the United States.” (Posner). But note that the insurance premium is also “out-of-pocket” there.

What both authors fail to mention, however, is that such a system, not relying on the payroll tax for financing, is characterized by a much reduced welfare cost of taxes, and thus does not discourage work in the way a payroll-tax-financed system does. As Larry Summers showed, a mandatory consumption does not generate a welfare cost the same way a tax does.

The Swiss system is the best example of what I suggest a French reformed (and US to be created) systems should look like (my paper "Comment gagner plus").

As noted by Posner “there is general satisfaction among the Swiss with their system, although there is some grumbling over the high cost of medical care”. But, I would add, this is because the Swiss pay their health-care insurance out of their own pocket and can switch for another insurer anytime. They thus pay -- quite logically -- more attention to its cost, while households that don’t even know that they are paying for insurance through the payroll tax don’t bother about the cost of insurance. This is an additional benefit of the Swiss system.

Tuesday, October 6, 2009

France Is 100% Bentham

Certainly France is a Benthamite country, and the whole of the French bureaucratico-political class, as well as “intellectuals”, agree on one point: leave the experimental evolutionary approach to ignorant foreigners (especially “anglo-saxons” ones).

Hat tip to Greg Mankiw.

Sunday, October 4, 2009

What the Bears Think

Friday, October 2, 2009

John Kay and Martin Wolf join the Classical Banking Club

Martin Wolf now does the same in the Financial Times (“Why narrow banking is not the finance solution”, September 29), although he criticizes Kay for not considering the risk that would remain in the “quasi-banks” that would still be allowed to invest in long-term and risky assets on “wafer thin equity” and short term borrowing.

He prefers the more complete proposal of Laurence Kotlikoff (Boston University) that was favorably commented upon on this blog (“The Classical Banking Club: Further suggestions”, May 14). For Kotlikoff and co-authors, all financial firms should be organized according to the principle of “limited purpose banking”, in which no leverage would be authorized and assets should be both specialized and matched by a same amount of equity -- and not by short term deposits. That equity would be borne by investors in these funds, who would thus be supposed to know the risks they would accept, as all shareholders are supposed to do. The possible failure of such funds would not endanger depositors in the much less risky “classical banks”, and would thus not choke the payment and credit system, nor coerce in that way the financial authorities into salvaging them.

The conclusion of Kotlikoff and co-author Goodman (The New Republic, May 14) is still valid however: “Bankers will likely fight this reform tooth and nail” and, I would add, would divert attention by suggesting new regulation instead.

Martin Wolf concludes on a somewhat more optimistic note: “The authorities will not entertain such radical ideas right now. But the financial system is so inherently fragile that radical reform cannot be pronounced dead. It is only dormant”.

Tuesday, September 29, 2009

Greg Mankiw Misreads Larry Summers

I think that Mankiw is wrong and did not read Summers thoroughly. Summers wonders indeed:”Are there differences in the real effects of mandated benefits and tax-financed programs?” And he goes on “…I find that there are important differences in the efficiency and distributional consequences of standard public provision and mandated benefits programs. Essentially, mandated benefits are like public programs financed by benefit taxes. (My emphasis. And this last sentence is the only one quoted by Mankiw).”

But then Summers adds in section 2, titled “Mandated Benefits or Public Provision”:

“It is often asserted that mandated benefits are just hidden taxes with the same efficiency and incidence implications as taxes, so that the choice between public provision and mandated benefits should depend only on the relative efficiency with which employers and the government can provide a service. I challenge the equivalence of these two methods of provision below.”

A first reason for doing so is that privately supplied mandated benefits preserve a margin of choice regarding the quality of service. Public provision supplies the same service to all, while some of the insured, given a choice, would select a lower quality and lower cost service, while others would prefer higher quality and cost. There is thus a welfare loss inherent in a one-size-fits-all insurance service and price.

More importantly,though, Summers sees differences in welfare deadweight losses:

“Another argument in favor of mandated public benefits rather than public provision is that mandated provision avoids the deadweight loss of tax-financed provision”. And he quotes various evaluations of the importance of the deadweight loss in the literature (Stuart, Browning, and others).

This is precisely the argument I use in my proposal for a reform of the health insurance systems in France and Europe (“Comment gagner plus?” Commentaire, 2009, downloadable on my personal homepage) advocating a repeal of the current dual purpose tax-financed public provision, in which the tax serves the dual purpose of covering the health care expenses (an insurance scheme) on the one hand, and redistributing income from the high wages earners to low wage earners through the payroll tax, in order to supply to the latter the same public provided health insurance coverage but at a much lower cost than to higher wage earners, on the other hand.

What I suggest is to limit the use of a payroll tax to this second, redistributive, aspect (about one third of the current tax), and to replace the publicly supplied insurance by a privately purchased but compulsory health insurance. This would reduce the payroll tax by about two third, and the deadweight loss by the same proportion. It would thus allow for a major reduction in the level of taxes in Europe, given that the payroll tax financed health insurance amounts to about 8 to 12percent of GDP. A reduction of two third of these taxes would represent a tax cut of about 5 to 8 percent of GDP -- a major tax rebate, without any cut in the services provided to insured people.

Definitely, such a mandated benefit formula cum the same income redistribution characteristics as the present systems (a health care insurance voucher for lower income households) would constitute a Paretian improvement over the present European tax financed and publicly supplied health insurance systems. And it would boost growth too.

I would be glad to know what Greg Mankiw thinks of such a reform.

Wednesday, September 23, 2009

Pourquoi, oh pourquoi l'Europe?

« Ni la réussite, le dynamisme, ni le taux d’imposition d’une nation ne dépendent de sa taille : les petits Suisses (6 millions) et les Américains (des US, 300 millions) sont performants et avec un Etat à l’optimum. Idem avec des Etats qui ont des taux de prélèvements obligatoires élevés : Suède, France, Chine » (sic).

Grand merci à M. Chevallier pour le soutien qu’il apporte à mon argumentation. J’explique en effet qu’un grand marché intérieur n’est pas nécessaire, aujourd’hui, à la prospérité de l’économie puisque les entreprises d’un petit pays ont accès au grand marché mondial du fait de la libéralisation générale des échanges (la mondialisation). Il s’ensuit que là où la grande dimension de la nation, et donc du marché intérieur, constituait un avantage certain pour les grandes entreprises américaines dans une ère de protectionnisme et de cloisonnement de l’économie mondiale, au cours du « premier vingtième siècle » allant jusqu’aux années 60, le grand marché « intérieur » européen, qui a été très utile à ses débuts, n’apporte pas de contribution significative à la prospérité des entreprises aujourd’hui. On ne peut donc pas fonder une argumentation favorable à la construction d’un grand ensemble européen sur cet argument obsolète.

D’autre part, M. Chevallier nous assure (comment le sait-il ?) que la dimension des divers Etats, de la Suisse à la Chine et de la France à l’Allemagne, est partout « optimale » et que d’ailleurs elle n’affecte en rien la performance économique de ces nations.

Mais alors, question sans doute trop naïve de ma part, pourquoi vouloir intégrer à toute force les Etats de la France, de l’Allemagne, et de quelques autres pays européens en un grand Etat continental commun puisque chacun de ces pays bénéficie déjà de la dimension optimale de son appareil étatique?

Il s’ensuit que, selon M. Chevallier, la construction européenne n’est nécessaire ni à la productivité des entreprises, ni à l’efficacité des Etats. C’est le point de vue que je défendais dans l’article qu’il juge sans aucun intérêt.

Peut-être n’ais-je pas saisi sa critique ?

Tuesday, September 22, 2009

The US Recession and the Demand for Money

For a clear statement of the problem read David Beckworth's blog Macro and Other Market Musings here .

Monday, September 21, 2009

Banker Pay NOT the Problem

John Kay’s argument, for instance, about the “New Peter Principle” (Financial Times, August 25) according to which top managers (and bankers) always reach their incompetence level and then waste shareholders’ wealth by mismanaging, thus leading the economy into crisis, is based on a faulty understanding of the classical agency problem well known to financial economists. The loss of control by shareholders was there on a permanent basis well before the crisis. It explained some waste but at a steady level. In order to cause the excesses of the recent years it should have been increasing steeply, all of a sudden, and there is no evidence of such an increase in the loss of shareholders'control.

Moreover, the fact that managers reach their level of incompetence does not mean that from that point on they will systematically make all the wrong decisions, ruining the firms they manage. It is a mechanism for allocating scarce talent among firms, not a macroeconomic decrease of the agregate amount of talent in the economy.It means on the contrary that the allocation of managers to positions is optimal, i.e. maximizing the total wealth they create for their firms.

The reason is that their incompetence is marginal. At the margin of the amount of business they supervise, their marginal productivity is decreasing up to the point where the value that they create is just equal to the payment they receive from the firm. Thus they should not be allowed to develop the volume of business under their control any more. But this is true of all contributions from factors of production in the neoclassical analysis. It does not lead to any “crisis”.

True, there is indeed a large responsibility of banks in the current crisis (excess diversification in risky activities, too big to fail problem) but excessive payments to greedy bankers is not central, and one can fear that it is used to draw attention away from the main difficulties and possible solutions.

Read the Cowen post here .

Krugman Proved Wrong : Levine

Hat tip to Greg Mankiw.

Monday, September 14, 2009

A Critique of the European Central Bank

Rebecca (NewsNEconomics) argues that the ECB didn’t do enough to support the Eurozone economy. She posts an interesting graph (above). The point is well taken, but disequilibrium, within zone, implicit exchange rates exert an even worse effect on activity.

Read the paper here .

Sunday, September 13, 2009

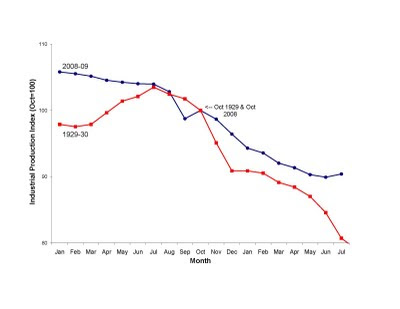

The « Great Recession » in Perspective

Above is a Bureau of Economic Analysis (BEA) presentation of the history of recessions and of the Great Depression, posted by Greg Mankiw on his blog (September 9).

Apparently I was right to claim almost from the start, and on this blog (“Raison garder”, November 28, 2008), that the magnitude of the current crisis was not, in any way, comparable to that the Great Depression.

Saturday, September 12, 2009

Tens of Thousands Rally Against Big Government in Washington D.C.

But what’s surprising in fact is that such a protest comes so late, while governments have kept growing, in the US as elsewhere, in an era of general downsizing of all hierarchical organizations (and the state is a country’s largest one usually), against the “natural” trend deriving from the information and communication revolution.The massive transfers operated during the financial crisis may have triggered a new awareness of the contradiction, while inducing the Obama administration to (wrongly) believe that the New Deal interventionist era was back for good.

Economic Revolutions and General Purpose Technologies

To truly modern economic growth – not just one doubling of wealth but repeated, ongoing doubling – no narrowly-focused set of inventions will suffice. You need broad-based economic growth produced by constantly revolutionizing technologies in most of not all of the economy.” (“Leading Sector Technology and Aggregate Economic Growth: A Finger Exercice”, De Long’s blog, September 7, 2009).

It means, I would like to add, that only “General Purpose Technologies” (GPT) can bring about an economic revolution. It was the case of electricity and of gas powered engines in the 1920s, and it is of course the case of IT today.

Thursday, September 10, 2009

Do Central Banks and Independent Economists Mix?

Things are even worse on this side of the Atlantic since criticisms of the European Central Bank (other than on technical niceties) amount to zilch, and the bank controls the profession through employment of economists, research grants, and gate keeping of journals and publications by affiliates, helped in this task by national central banks (Yes, they still exist despite monetary integration!). Hence the dominance of monetary macroeconomics, and the overall approval of the euro by European economists, even when they voice some superficial doubts, only to better refute real and fundamental criticism.

But it would be fair to add that central banks, in turn, are extremely dependent on financial big businesses.

Inflation or Deflation?

Charles L. Evans, President and Chief Executive Officer, Federal Reserve Bank of Chicago, thinks “neither a harmful deflationary episode nor a repetition of the Great Inflation (1965-1982) is very likely” and develops an interesting argument leading to that conclusion.

A link to his paper: here .

Wednesday, September 9, 2009

American Capitalism and the Corporatist Trap

“This would mean abandoning the notion that any firm is too big to fail, and putting rules in place that keep large financial firms from manipulating government connections to the detriment of markets. It would mean adopting a pro-market, rather than pro-business, approach to the economy.

The alternative path is to soothe the popular rage with measures like the limits on the executive bonuses while shoring up the position of the largest financial players, making them dependent on government and making the larger economy dependent on them. Such measures play to the crowd in the moment, but threaten the financial system and the public standing of American capitalism: a path that blurs the distinction between pro-market and pro-business policies, and so imperils the unique faith the American people have long displayed in the legitimacy of democratic capitalism.”

Bravo. Unfortunately, the European governments have precisely chosen this "alternative path" and it is no happenstance. Readers of this blog will make the parallel with my denunciation of “patronalisme” (systematic pro-business and anti-growth policies) which, I claim, explain in large part the dismal performance of the corporatist European economies (September 8, 2008, “L’erreur historique de Jean Peyrelevade”, also published in Commentaire, n° 124, Hiver 2008-2009, and see also my "La crise des capitalismes hiérarchiques" in Commentaire, also downloadable on my website).

For a first step in the direction of a return to a competitive (and ethical) capitalism, it is essential to make completely clear that a pro-market (or competition-enhancing) policy is quite a different thing from a pro-business one. A distinction that Europeans, raised in and accustomed to heavily corporatist and collusive economies, fail to understand. As a consequence they dub their collusive systems of big state and big business “ultra-libéralisme”, a characterization that is the exact opposite of the truth.

The Zingales paper is thus a must read here.

And I can only warn my American friends: do not follow the European way.

(Hat tip to Greg Mankiw for signaling the paper).

Monday, September 7, 2009

Economics Still Useful … and Fun

Saturday, September 5, 2009

Color Photos of Tsarist Russia, 1907-1915

http://www.newsweek.com/id/214585http://www.newsweek.com/id/214585

Tuesday, September 1, 2009

In Search of the Next Information Revolution

Read today’s New York Times article here .

Given the huge impact of the quantity (and cost) of information on organizational structures, further progress in that direction would comfort the decentralizing and democratizing trends initiated in the 1970s.

Monday, August 31, 2009

Germany Needs Tax and Spending Cuts: Solms

A major reform to be confirmed if he is elected, and an example for other European countries to follow.

Saturday, August 29, 2009

Concentration in US Banking

J.P.Morgan Chase now holds more than 10 percent of the country’s deposits, as does Bank of America (partly government-owned as a result of the crisis) and Wells Fargo.

Those three banks, plus government-rescued and –owned Citigroup, now issue one of every two mortgages and about two of every three credit cards.

As a result, depositors are seeing fewer choices and higher prices for financial services. “The oligopoly has tightened” comments Mark Zandi, chief economist of Moody’s Economy.com, even though the concentration ratios are much higher in other countries’ banking sectors added Treasury Secretary Timothy F. Geithner in an interview.

Another unhappy consequence is that “moral hazard”, the accrued incentive for these larger banks to return to the risky behavior that led to the crisis if they figure federal officials will rescue them again, is increased too.

The question now is: will this regulatory-induced concentration lead to a reduction of the sector’s excess capacity, one of the main causes of the crisis? (more on that on a future post). Since letting the capacity reduction operate through bank failure was obviously too dangerous, the chosen alternative way to do it is by merging big firms first, and then let the managers reduce the capacity of the merged institutions, thus avoiding to jeopardize their survival.

But managers do not like to do that as Michael Jensen (emeritus Harvard Business School) often emphasized: internal control systems often fail. It is to be seen if some pressure from the legal-political-regulatory system will succeed in reining in banking excess capacity.

Thursday, August 27, 2009

Which Path for Stocks : 1973 or 1929 ?

The above chart of four bad bear markets is informative … to a point. What’s next? A continuing rebound similar to the post oil crisis one, or another downtrend followed by stagnation after an initial rebound, à la 1929? Or else still, an in-between path? Read the analysis in the Online Stock Trading Guide here . And also have a look at their “1930 Stock Chart”.

Monday, August 24, 2009

US Green shoots … and doubts

Menzie Chinn posted this graph of current forecasts of US monthly Gdp (above) on his blog Econobrowser (August 19), under the title “Stabilization and Upswing … for Now”.

Among comments on his post I found this one interesting:

"Wow, even you guys are finally seeing the green shoots. Although the stock market has already ran up 50%."

But that one is more informative:

“Stock markets are a bad indicator for the status of the economy, since perception in the markets and reality can diverge to a large degree, and this for a long time.

As for economic recovery. Massive stimulus spending by governments has to show up somewhere. Thus, no surprise here, when there is one or more quarters of GDP-growth. The more important question is, whether this is the start of a new self-sustaining cycle of capital accumulation. I have big doubts here, since I don't see that any of the pre-conditions, the disproportions that led to the global recession have been really eliminated from the system. The world is still sitting on a mountain of debt. The total debt in the US-markets (private, companies, and government debt all together) to US GDP ratio was at about 375% as of Q1 2009, far higher than the debt bubble before and during the Great Depression, which deflated back then.

50 trillion US-dollars of debt and assuming 5% average interest rate means 2.5 trillion US-dollars a year alone to pay off interest, which has to be paid from generated income, if you don't want to deplete the capital stock. To generate a nominal income of 2.5 trillion in an 14 trillion US-dollar economy, the nominal GDP would have to rise by almost 18% a year, just to maintain the nominal debt level. In reality, it would be even more, of course, since the debt isn't equally distributed. The society is split in net creditors and net debtors. The 2.5 trillion interest payment would have to come from the income of the net debtors, which is smaller than the total income in society.

If this biggest debt bubble maybe in history bursts, and I don't really see how a deflation of this debt could be prevented forever, despite all efforts by governments globally, then, I am afraid, the global recession we have seen so far is nothing compared to what could be coming.

rc

Posted by: rootless cosmopolitan at August 20, 2009 07:59 AM “.

Maybe economists are too pessimistic, really …

Friday, August 21, 2009

The Microchip Undermines European Centralization

Despite its still substantial share of world production and its military spending vastly greater than that of the rest of the world put together, the US influence is on the wane. Pax Americana is today as much of history as Pax Britannica. The reason lies in one word – the microchip. “Size no longer equates with power. (…) The miniaturization of weaponry, combined with the communications revolution, has given birth to an irreversible asymmetry of warfare and violence. The power to organise, to coerce and to strike has been placed in the hands of a horde of non-state players and activists, both good and bad. (…) This power is in the reach of the smallest extremist group and the most rogue-inclined rulers.”

“Suddenly, it is no longer a question of Western dominance and who between Europe and America calls the shots. The answer is neither. (…) In this international scene of extraordinary fluidity and uncertainty, the EU cannot afford the stilted rigidity of direction which treaty procedures and formalities of hierarchy impose.”

This clearly spells the end of the centralist project. Some European countries can act effectively on specific issues, but not on everything, and not all together. A united (read “monopolist and vertically integrated") Europe “cannot substitute for the growing mesh of bilateral relations that the information age has created.”

The whole paper is worth reading, here.

Monday, August 17, 2009

Appetite for Risk Wanes Again

The information circulates so rapidly in our globalized world that as soon as a diagnosis is formulated, and if correct, events follow. A rule for investing in rather efficient markets: don't wait.

Anaemic Rather than Robust Recovery in Advanced Economies

The bottom of the recession is quite close but it has not yet been reached. Households need to deleverage and save more, the financial system is severely damaged , the corporate sector faces a glut of capacity and deflationary pressures still persist, while the public sector’s debt accumulation risks crowding out a recovery in private sector spending.

A double-dip is not to be excluded and growth is likely to be below trend for “at least a couple of years”. As to the recent market rallies in stocks, commodities and credit, they may have gotten ahead of the improvement in the real economy. “If so, a correction cannot be too far behind.”

Sounds reasonable.

http://www.bearmarketinvestments.com/roubini-project-syndicate-op-ed-a-phantom-economic-recovery

Saturday, August 15, 2009

Are Economists Too Cautious ?

According to Rebecca Wilder (News N Economics) economists currently forecast a “pathethic recovery” (July 21, 2009). But this is usually what they do writes Angry Bear’s Spencer:

“they have a long and repeated history of underestimating the strength of the recovery”.

Sunday, August 9, 2009

Mr. Ackermann and the Case for Big Banks

Simon Johnson disagrees here .

Saturday, August 8, 2009

Health Care : Market Solutions

All the current problems have been debated for a long time. See for instance the book I edited in 1990, Comparative Health Systems in Ten Industrial Countries (JAI Press), and (in French) my recent paper “Comment Gagner Plus?” Commentaire, Printemps 2009).

I maintain that most of the alleged "excessive cost" problem of health care comes from the tax financing of health care spending in socialized medecine systems – a tax on labor that hinders economic growth - and not from a somewhat “excessive” level of consumption, that no one can define except the consumers themselves.

Minimize the tax financing by limiting its use to a policy of subsidizing private buying of health care insurance for low income houselholds, and the problem will disappear.

Flier shows convincingly that all the current objections to market solutions do not resist a serious evaluation.

Unemployment rate down in the US

Thursday, August 6, 2009

Jews As Overseas Chinese …

Gilder mentions Thomas Sowell of the Hoover Institution who reports that in Indonesia the Chinese were 5 percent of the population, but they controlled 70 percent of private domestic capital and ran three-quarters of the nation’s top 200 businesses. These “middlemen minorities”, "their wealth inexplicable, their superiority intolerable”, typically arouse hatred from competing intellectuals. Yes, you correctly read it: intellectuals, not low brow, ordinary blue collar people, and social rivals, feeling threatened.

A great, enjoyably politically incorrect article, and a must read.

Wednesday, August 5, 2009

The Modern Decline of Violence

While “all the horrific wars and genocides of the 20th century accounted for less than 3 percent of all death worldwide, according to one estimate (...) the anthropologist Lawrence Keeley estimates in his influential book War Before Civilization, that violence accounted for as many as 25 percent of all deaths among early societies.” War emerged and rapidly spread as hunter-gatherers adopted a sedentary lifestyle and agriculture, and as populations grew.

Horgan also reports the reasons that Harvard psychologist Steven Pinker suggests as an explanation for the (relatively) peaceful attitude of modern men. The complete article is well worth reading, even at the beach.

Tuesday, August 4, 2009

Bankers’ Bonuses

“Bank bosses were adamant yesterday that they would continue to pay seven-figure bonuses to workers, describing them as ‘essential if we want people to work in our industry’ ” write journalists James Moore and Nigel Morris.

But precisely that’s the question: which people should they hire? Should banks continue their operations in sophisticated and high risk products that require these high-calibre graduates? In the past, when they were content with selling traditional credit products, they apparently did not need very sophisticated (and expensive) personnel, any more than insurance companies did.

In a narrow banking perspective – much more favorable to depositors’ and taxpayers’ interests – banks should stop paying these big bonuses, and stop recruiting these specialists.

Maybe such a reorientation is not just wishful thinking after all. As reported by The Independent, banks “also claimed that high-calibre graduates were starting to think twice about working in the financial services industry because of the growing backlash against bankers.” Let’s hope that they correctly anticipate future trends.

Monday, August 3, 2009

Too Big To Fail : A Tentative List

Here are the first 17 largest banks of their Box 4-1 out of a list of 34:

Bank ( Assets in billions of US dollars)

Citicorp (1.068)

J.P. Morgan Chase and Company (799)

Bank of America Corporation (640)

Deutsche Bank AG (514)

Misuho Holdings (422)

Stitching Prioriteit ABN AMRO (382)

UBS AG (357)

Wachovia Corporation (326)

Wells Fargo and Company (298)

Bank One Corporation (270)

Credit Suisse Group (255)

MetLife (252)

HSBC Holdings PLC (240)

FleetBoston Financial Corporation (202)

U.S. Bankcorp (168)

BNP Paribas SA (119)

Mitsubishi Tokyo Financial Group (114)

At a time when the financial industry that was bailed out at taxpayer expense is paying itself gigantic bonuses while the economy is still deeply depressed (as Paul Krugman writes in the New York Times, “Rewarding Bad Actors”), Josef Ackerman, head of the Deutsche Bank and of the global bankers’ trade union, the Institute of International Finance, makes the case for big banks in the Financial Times. The problem, he writes, is not size, but that the banks are too interconnected to be allowed to fail.

This would not be the case if the “narrow banking proposal” or other “classical banking” schemes were adopted. Separate lines of business would be served by specialized institutions, each of which would be of a size small enough (as defined by regulation) not to jeopardize the security of the whole system.

See also the commentary in the August 2 issue of the Financial Times by Tony Jackson, with a proposal that banks be obliged to pay insurance premiums in every country where they do business not only to insure against going bust but also in case they should be rescued (“A bank-weary taxpayer’s pipe-dream”).

“The obvious counter is if one country introduced such a scheme, banks would emigrate. But the simpler and more local the banks, the less that is an option.”

That’s why narrow banking and small size limits are now necessary.

The Classical Banking Club welcomes Paul Krugman and Tony Jackson.

Saturday, August 1, 2009

Is GDP growth undermining democracy?

An interesting post by Brad Setser and Paul Swartz of the Council on Foreign Relations (“Geoeconomics, in pictures”, July 31) here , shows how the share of world GDP by governance form, i.e. autocracy and democracy, could be converging during the next few years, due to the new growth of emerging economies which are ruled by an autocratic regime.

It could well be, on the other hand, that economic development would bring about a change of political regime in many countries, and raise the number and GDP weighted share of democratically governed countries.

Thursday, July 30, 2009

End of the recession? Erratum

Its underlying economic indicators (weekly initial jobless claims; monthly payroll employment, industrial production, personal income less transfer payments, manufacturing and trade sales; and quarterly real GDP) blend high- and low- frequency information and stock and flow data.

According to this index the recession began in the last quarter of 2007, and it could be finished apparently by early 2010, barring a “W” episode that could prolong it a bit.

The text under the graph was intended to present the same index in perspective, first from 2000 to present, and then from 1960 to present. Both graphs are available on Econbrowser or from the Philadelphia Fed here .

Hat tip to Econbrowser and apologies to the readers for the mistaken post.

-5.0

-4.5

-4.0

-3.5

-3.0

-2.5

-2.0

-1.5

-1.0

-0.5

0.0

0.5

1.0

1.5

2.0

2.5

3.0

1965 1970 1975 1980 1985 1990 1995 2000 2005

Aruoba-Diebold-Scotti Business Conditions Index (3/1/1960-7/18/2009)

Business Conditions

Note: We construct the ADS Index using the latest data available as of July 23, 2009. This includes (1) initial jobless claims through the week ending July 18, 2009,

(2) payroll employment through June 2009, (3) industrial production through June 2009, (4) real personal income through May 2009, (5) real manufacturing and trade sales

through April 2009, and (6) real GDP through the first quarter of 2009. Gray shading indicates historical NBER-designated recessions. Yellow shading indicates the most recent

recession, designated by the NBER to have started in December 2007 but not yet (as of the date of creation of the figure) designated by the NBER to have ended.

Big Cities or the Virtual Megalopolis?

While monetary rewards on the Internet are still scarce, it is true, the cost of living in the virtual world is cheap and, more important, the opportunities for attention are plentiful.

But there is a catch: the Internet is tougher than New York; fewer people make it here, and no one there seems to make it for long.

A great paper written by Bill Wasik, a senior editor at Harper’s, for the New York Times (“Bright Lights, Big Internet”, July 29, 2009) here .

Wednesday, July 29, 2009

Can the West Save Africa ?

“In the new millennium, the Western aid effort toward Africa has surged due to writings by well-known economists, a celebrity mass advocacy campaign, and decisions by Western leaders to make Africa a major policy priority. This survey contrasts the predominant “transformational” approach (West comprehensively saves Africa) to occasional swings to a “marginal” approach (West takes one small step at a time to help individual Africans). Evaluation of “one step at a time” initiatives is generally easier than that of transformational ones either through controlled experiments (although these have been oversold) or simple case studies where it is easier to attribute outcomes to actions.

We see two themes emerge from the literature survey: (1) escalation – as each successive Western transformational effort has yielded disappointing results (as judged at least by stylized facts, since again the econometrics are shaky), the response has been to try an even more ambitious effort, and (2) the cycle of ideas – rather than a progressive testing and discarding of faded ideas, we see a cycle in aid ideas in many areas in Africa, with ideas going out of fashion only to come back again later after some lapse long enough to forget the previous disappointing experience. Both escalation and cyclicality of ideas are symptomatic of the lack of learning that seems to be characteristic of the “transformational” approach. In contrast, the “marginal” approach had some successes in improving the well-being of individual Africans, such as the dramatic fall in mortality.”

Meanwhile, I would add, Africans themselves are transforming their societies piecemeal, the result being highly visible even to the casual visitor, either in the sustained urbanization trend which also has positive sides despite the obvious costs and difficulties that it raises, or in the effervescence of artistic creation leading to the formation of entirely new industries (movies, painting, performing arts and music) that are connected to international markets and not limited to local, traditional folklore.

In spite of the failure of the African food production relative to the green revolution in Asia (Easterly’s figure 10), income per capita has resumed an upward trend since 2000, after three decades (1970-2000) of stagnation (Figure 1).

Small steps, both external and internal, may at last lead to some sustainable progress.